Crafting innovative solutions that drive growth, efficiency, and success

From digital banking and payment solutions to compliance and risk management, we offer a comprehensive suite of services tailored to your unique needs. Whether you're a startup looking to disrupt the industry or an established institution seeking digital transformation, we have the expertise and technology to help you achieve your goals.

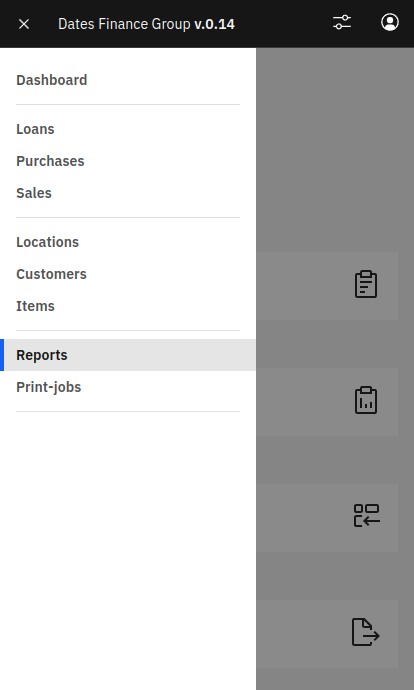

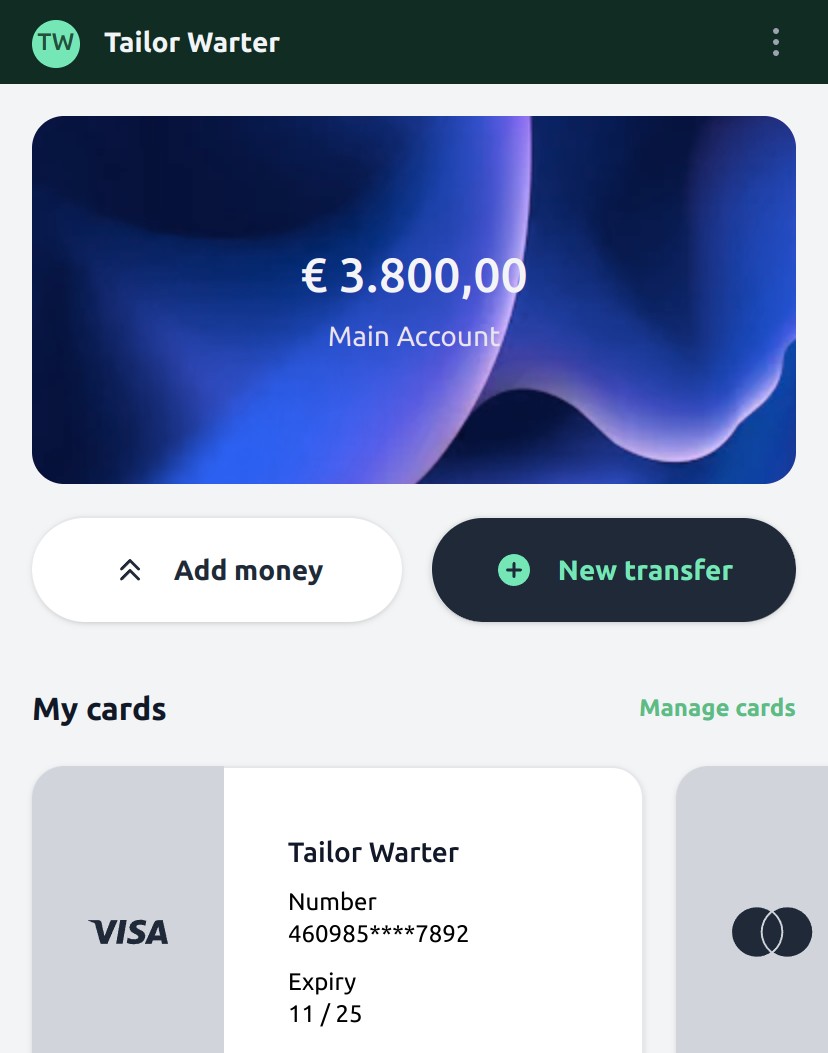

Digital banking app

Paymaster

Single-code-base app provides a seamless and intuitive banking experience, allowing users to access their accounts, transfer funds, pay bills, and more, all from the convenience of their mobile device or web-application.

- Credit Card Management.

- From tracking transactions and monitoring spending to setting up alerts and managing rewards, our credit card management feature puts you in control of your finances.

- Investment Platform.

- Our platform provides access to a custom investment option, allowing users to build a easily manage and monitor their investments.

- IBAN accounts.

- With our digital banking app, users can easily open and manage IBAN accounts for seamless international transactions.

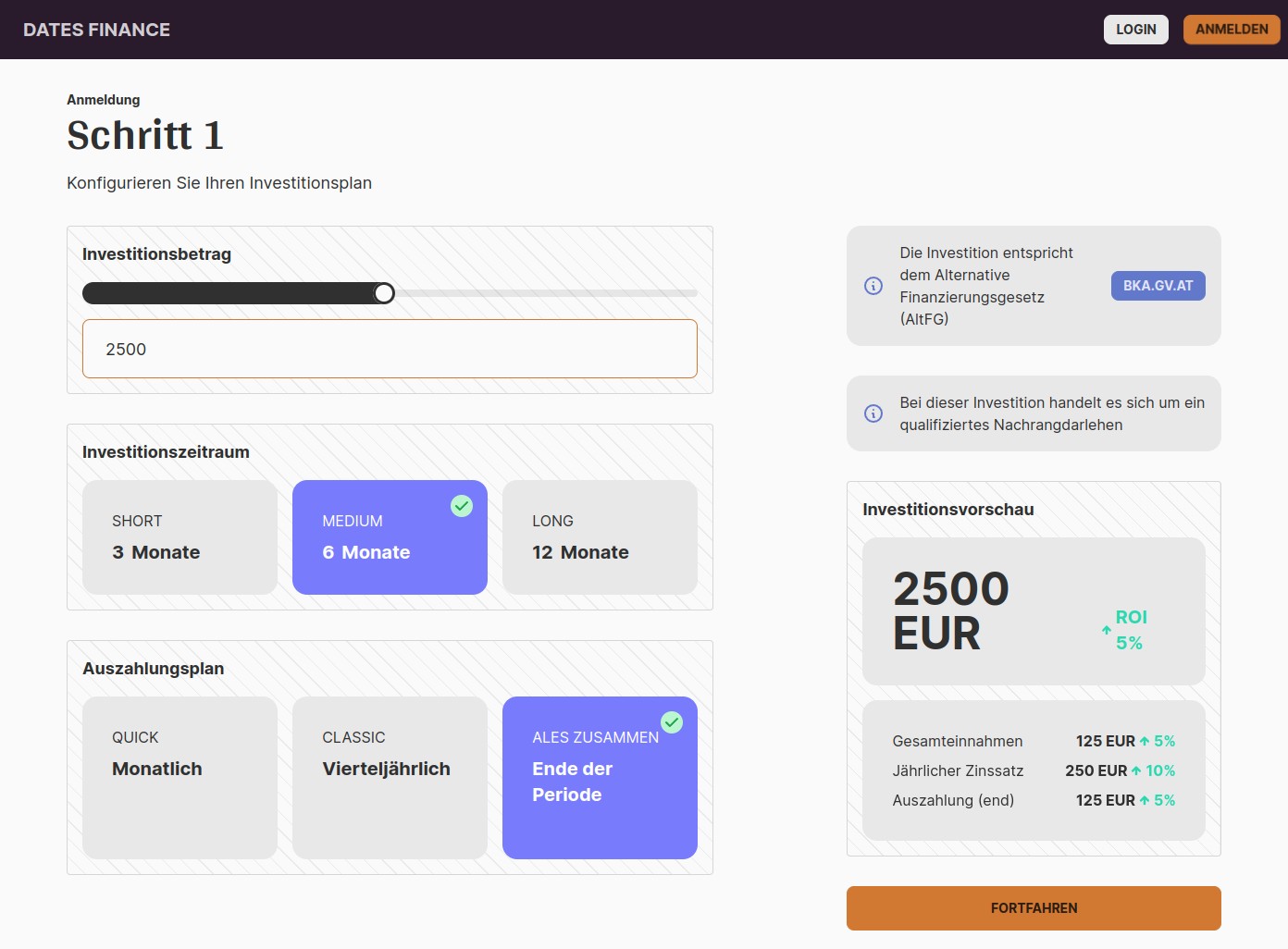

Investment platform

Bonder

User-friendly design to provide investors with a seamless and intuitive investment experience.

- Integration with Client's Backend.

- Our platform is designed to integrate seamlessly with a wide range of backend systems, including CRM, ERP, and accounting software, allowing you to streamline operations and access real-time data across your organization.

- Reporting and Analysis.

- With advanced analytics and powerful visualization tools, you can track customers' progress, identify trends, and make informed management decisions with confidence.

- Easy Interface.

- Our investment platform features an intuitive interface that makes investing simple and straightforward. With clean design and easy navigation, users can quickly access key features, research investment opportunities, and execute trades with ease.

POS for loan-office

Score

Introducing our advanced Point-of-Sale (POS) system tailored specifically for loan offices. Our POS solution streamlines the loan application and approval process, providing loan officers with the tools they need to deliver fast, efficient, and customer-centric service. With intuitive features and robust functionality, our POS for loan office revolutionizes the way loans are processed, empowering loan officers to maximize productivity and customer satisfaction.

- Process Automation.

- Our POS for loan office automates key processes, reducing manual tasks and streamlining operations. With automated workflows and intelligent decision-making algorithms, loan officers can accelerate the loan application and approval process, minimizing errors and improving overall efficiency.

- Inventory Management.

- Score's system of location and scanners enables loan offices to track loan products, terms, and rates, ensuring accurate and up-to-date information at all times.

- ERP and Tax-office integrations.

- With built-in tax calculation and reporting features, loan offices can streamline tax-related processes, reduce administrative burden, and focus on serving their customers effectively.